As someone deeply immersed in the world of real estate, I’ve witnessed firsthand the profound effects that foreign investment can have on local property markets. The influx of capital from overseas investors has the power to reshape neighborhoods, drive up prices, and spark debates about affordability and gentrification.

In this article, I’ll delve into the intricate dynamics at play when foreign money flows into domestic real estate. From bustling metropolises to quaint suburban communities, the influence of foreign investment is palpable across a spectrum of locales.

As I explore the nuances of this phenomenon, I’ll shed light on both the benefits and challenges it brings to the table. Join me on this journey as we uncover the far-reaching impact of foreign investment on our very own backyard the local real estate market.

Understanding Foreign Investment in Real Estate

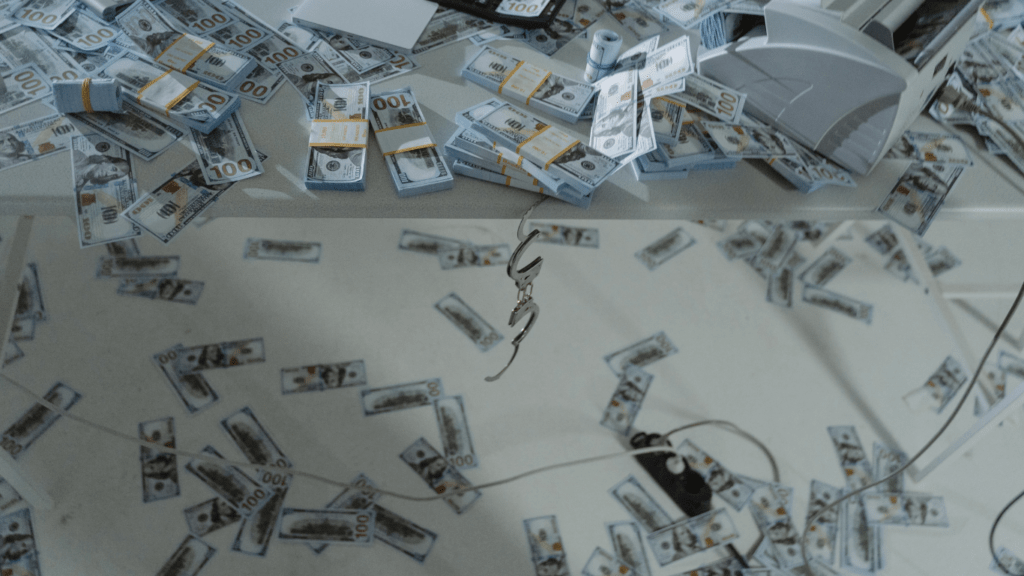

Foreign investment in real estate plays a pivotal role in shaping the dynamics of local property markets, driven by global financial flows. This external capital influx can drive demand, raise property values, and stimulate economic growth, but it also presents challenges such as affordability concerns and potential displacement of local residents, sparking debates on gentrification.

As we explore the complexities of foreign investment, it becomes clear that while it brings liquidity and development opportunities, it can also fuel speculative behavior that affects housing accessibility for local communities. Understanding these interactions is essential for navigating the evolving landscape of global capital’s impact on domestic real estate.

Factors Driving Foreign Investment

Foreign investment in local real estate markets is primarily driven by two key factors:

Economic Stability

Stable economies attract foreign investors seeking secure assets that offer a hedge against volatility in their home countries. Local real estate markets in economically stable regions provide a safe haven for capital preservation and potential long-term returns.

The perceived economic stability of a country influences the decision-making process of foreign investors, prompting them to diversify their portfolios by investing in real estate assets abroad.

Market Diversification

Foreign investors often pursue market diversification as a strategy to spread risk across different regions and sectors. Investing in local real estate markets offers diversification benefits by reducing exposure to risks inherent in a single market.

By spreading their investments geographically, foreign investors can mitigate risks associated with economic downturns, regulatory changes, or market-specific events. Market diversification through real estate investments provides foreign investors with opportunities for capital growth while minimizing potential losses.

Impacts of Foreign Investment on Local Real Estate Markets

Exploring the effects of foreign investment on local real estate markets reveals a multifaceted landscape where external capital significantly influences property dynamics. Analyzing the interplay between global financial inflows and domestic property markets underscores the transformative power of foreign investment.

In this section, I delve deeper into the specific impacts of foreign capital infusion on local real estate markets, unraveling the intricate web of advantages and challenges it brings.

Advantages of Foreign Investment

- Increased Property Values: Foreign investment often leads to heightened property values in local real estate markets. The injection of external capital can spur demand for properties, subsequently driving up prices and boosting overall market value.

- Enhanced Liquidity: The influx of foreign capital can enhance market liquidity by broadening the pool of potential buyers and investors. This increased liquidity offers more opportunities for property transactions, stimulating economic activity within the real estate sector.

- Economic Growth: Foreign investment can act as a catalyst for economic growth in local communities. By attracting international investors, regions can benefit from job creation, infrastructure development, and overall economic prosperity.

- Affordability Concerns: One of the primary challenges associated with increased foreign investment is affordability issues for local residents. As property values rise due to external capital inflow, it can become more challenging for residents to afford homes in rapidly appreciating markets.

- Potential Displacement: The surge in property prices driven by foreign investment may lead to the displacement of long-term residents. Gentrification, triggered by rising property values, can push existing community members out of their neighborhoods, raising concerns about social cohesion and inclusivity.

In analyzing the impacts of foreign investment on local real estate markets, it becomes evident that while this phenomenon brings substantial benefits such as economic growth and increased property values, it also poses challenges related to affordability and community cohesion. Understanding the delicate balance between these advantages and drawbacks is crucial in navigating the evolving landscape of global capital influence on neighborhood dynamics.

Challenges and Controversies

Continuing the exploration of foreign investment in local real estate markets, I delve into the challenges and controversies associated with this dynamic phenomenon. As an experienced real estate professional, I aim to shed light on the complexities that arise when foreign capital merges with domestic property markets.

Multifaceted Regulatory Issues

Navigating the regulatory landscape poses a significant challenge in the realm of foreign investment in local real estate. Compliance with diverse regulations, varying from country to country, can be cumbersome for both investors and local authorities.

Understanding and adhering to legal requirements and tax obligations add layers of complexity to transactions, impacting the ease of conducting business.

Affordability Concerns for Local Residents

One of the primary controversies linked to foreign investment is the potential impact on housing affordability for local residents. As property prices surge due to increased demand from foreign investors, residents may face challenges in accessing affordable housing options.

This disparity in affordability levels can lead to social tensions and a sense of exclusion within the community.

Gentrification and Displacement Risks

The influx of foreign capital into local real estate markets can accelerate gentrification processes, altering the social fabric of neighborhoods. Gentrification often results in the displacement of long-term residents as property values rise, making it difficult for existing community members to afford to stay in their neighborhoods.

Balancing investment-driven revitalization with the preservation of community identity becomes a key challenge in mitigating displacement risks.

Economic Vulnerability to External Factors

Reliance on foreign investment exposes local real estate markets to external economic factors beyond their control. Fluctuations in global markets, changes in foreign policies, or shifts in investor sentiment can swiftly impact property values and market stability.

This vulnerability to external influences underscores the importance of fostering sustainable growth strategies that shield local markets from abrupt shocks.

Transparency and Data Accessibility

Ensuring transparency and access to reliable data in foreign investment transactions is crucial for maintaining market integrity. Lack of transparency can lead to misinformation, market distortions, and unethical practices. Establishing mechanisms for transparent reporting and data sharing is essential for monitoring the impact of foreign investment on local real estate markets and safeguarding against illicit activities.

In scrutinizing the challenges and controversies surrounding foreign investment in local real estate markets, I aim to provide a comprehensive overview of the multifaceted issues at play. By examining these complexities, we can better understand the nuances of this transformative phenomenon and work towards addressing the inherent challenges to foster sustainable and inclusive real estate markets.