When it comes to buying a home, your credit score plays a crucial role in determining your mortgage options. As someone who has navigated the realm of real estate, I understand the significance of a good credit score in securing favorable loan terms.

Lenders use this three-digit number to assess your creditworthiness, influencing the interest rates and loan amounts you may qualify for. In this article, I’ll delve into the intricate relationship between credit scores and mortgage options.

From explaining how credit scores are calculated to outlining the impact on your borrowing capabilities, I’ll provide valuable insights to help you make informed decisions when pursuing a mortgage. Understanding the nuances of credit scoring can empower you to take proactive steps to improve your financial standing and enhance your chances of obtaining the home loan that suits your needs.

Understanding Credit Scores and Mortgages

Exploring credit scores in relation to mortgage options reveals crucial insights into the home buying process. Lenders rely on credit scores to assess creditworthiness, impacting interest rates and loan amounts.

Understanding how credit scores are calculated is vital as it directly influences borrowing capabilities for securing a suitable mortgage. This knowledge empowers individuals to make informed decisions that enhance their financial standing and increase their likelihood of obtaining a favorable home loan.

Importance of Credit Scores in Mortgage Approval

Maintaining a good credit score is crucial when it comes to securing a mortgage. Lenders heavily rely on credit scores to assess an individual’s creditworthiness, which significantly impacts the terms of the mortgage offered.

Credit Score Ranges and Mortgage Options

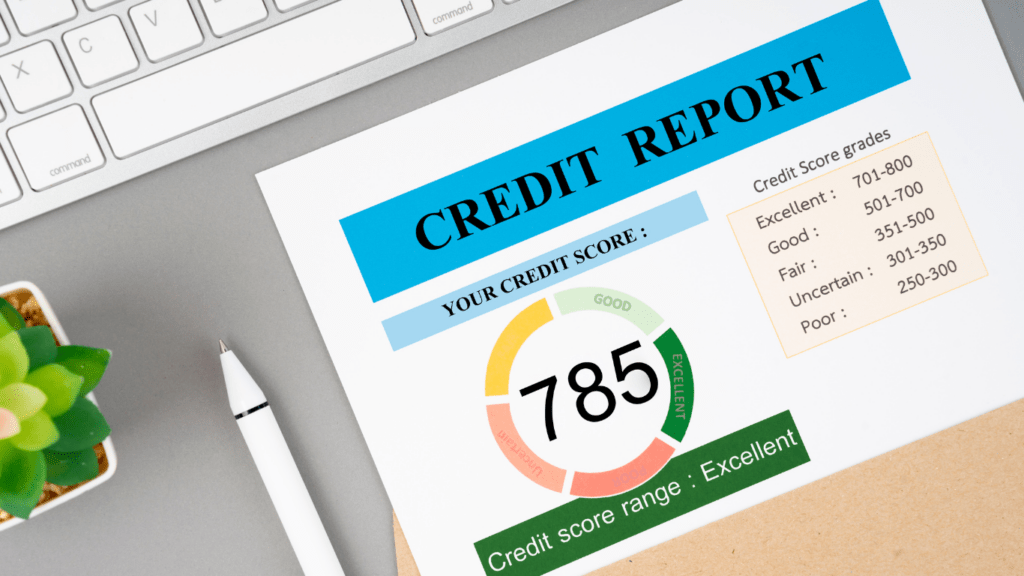

Credit scores typically range from 300 to 850, with higher scores indicating lower credit risk. For example, a score above 700 is considered good, while anything below 620 may pose challenges in obtaining a favorable mortgage.

Individuals with higher credit scores often qualify for lower interest rates and higher loan amounts, expanding their home buying opportunities.

Credit Score Requirements by Lender

Lenders have varying credit score requirements for mortgage approval. While some lenders may offer loans to individuals with lower credit scores, they often come with higher interest rates. On the other hand, borrowers with excellent credit scores enjoy more attractive loan options, including lower interest rates and better terms. Understanding the credit score requirements set by lenders is essential in selecting the most suitable mortgage option.

By maintaining a good credit score and being aware of lenders’ credit score thresholds, individuals can enhance their chances of securing a favorable mortgage with competitive terms.

Factors Influencing Mortgage Terms Based on Credit Scores

Exploring the factors that influence mortgage terms based on credit scores sheds light on the crucial role creditworthiness plays in home financing. As I delve into these aspects, it becomes evident that credit scores significantly impact the conditions borrowers face when seeking a mortgage. This examination reveals how different credit score brackets can lead to varying mortgage terms and opportunities, highlighting the importance of maintaining a solid credit history.

Here are key factors to consider when evaluating mortgage terms based on credit scores:

- Interest Rates: Interest rates on mortgages are directly tied to credit scores. Higher credit scores typically correspond to lower interest rates, translating to reduced long-term borrowing costs. For example, borrowers with scores above 760 often qualify for the best rates, while those with lower scores might face higher interest charges.

- Loan Amounts: Credit scores influence the maximum loan amounts borrowers can secure. Lenders assess risk based on credit scores, with higher scores enabling borrowers to access larger loan amounts. Individuals with excellent credit histories may qualify for substantial loans, whereas those with lower scores might be approved for smaller amounts.

- Loan Terms: The terms of a mortgage, such as the duration and type of loan, can vary based on credit scores. Borrowers with higher credit scores may have more flexibility in choosing favorable loan terms, including shorter repayment periods or fixed-rate options. In contrast, individuals with lower scores might encounter limitations in terms of loan duration and type.

Understanding how credit scores influence mortgage terms is pivotal for individuals looking to secure favorable home financing. By recognizing the significance of creditworthiness in the lending process, borrowers can take proactive steps to improve their credit profiles and enhance their chances of obtaining advantageous mortgage terms.

Tips to Improve Credit Scores for Better Mortgage Options

To enhance your credit scores and secure better mortgage options, follow these practical tips:

- Monitor Your Credit Report Regularly: Check your credit report frequently to spot errors or potential issues early on. You can request a free credit report annually from each of the major credit bureaus.

- Pay Bills on Time: Consistently paying your bills on time is crucial for maintaining a healthy credit history. Set up reminders or automatic payments to avoid missing due dates.

- Keep Credit Utilization Low: Aim to use only a small portion of your available credit. Ideally, keep your credit utilization below 30% to demonstrate responsible credit management.

- Avoid Opening Multiple Accounts Simultaneously: Opening several new accounts within a short period can lower your average account age and indicate financial distress, potentially impacting your credit score negatively.

- Do Not Close Unused Credit Accounts: Closing old or unused credit accounts can shorten your credit history and reduce the overall available credit, which may affect your credit utilization ratio.

- Diversify Your Credit Mix: Having a mix of credit types, such as credit cards, installment loans, and a mortgage, can positively impact your credit score. However, only apply for credit when needed.

- Work with Creditors for Solutions: If you’re facing financial difficulties, communicate with your creditors to explore potential solutions, such as payment plans or restructuring, to avoid negative impacts on your credit score.

By implementing these strategies, you can proactively improve your credit scores, paving the way for better mortgage options and favorable terms when purchasing a home.